Understanding the details of your auto insurance can seem daunting– especially if you’ve ever leafed through your 40-page policy contract. But fortunately, you don’t need to read the entire document to know what your coverage includes. For that, you have your insurance declaration page.

Think of the declaration page as the summary or cheat sheet for your auto insurance policy. It’s a concise, one or two-page document that outlines your basic coverage details. Getting familiar with this page can give you a clear idea of what you’re paying for.

Note: These tips should not be considered official insurance guidance. Please consult an insurance professional or broker when making decisions regarding insurance.

How to Use Your Auto Insurance Declaration Page

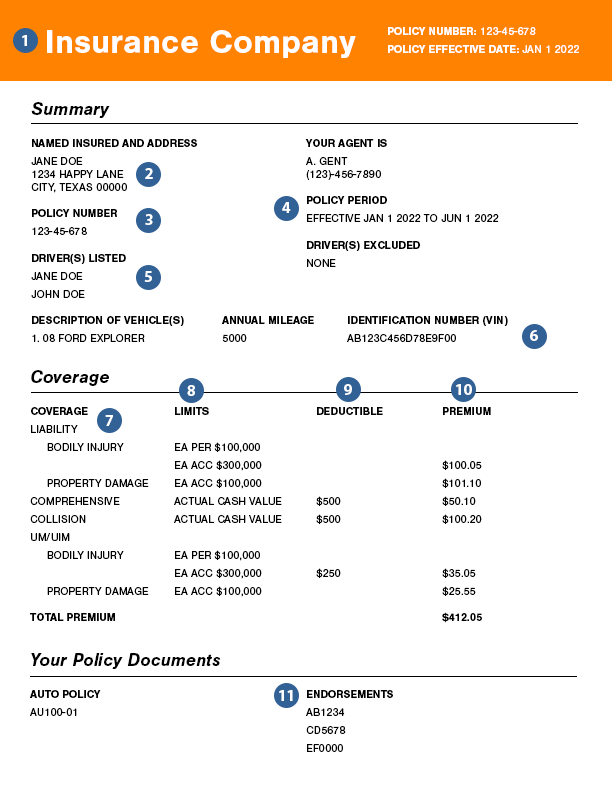

Your car insurance policy’s declaration page can give you a quick, at-a-glance overview of your policy. It consolidates key details like your policy number, the coverage period, and your limits for each type of insurance. This helps you determine if your policy aligns with your personal needs and any lender or lessor requirements.

Contrary to popular belief, your auto declaration page isn’t meant to be used as proof of insurance. If you need to provide your coverage information, it’s recommended to use your ID card, a certificate of insurance, or even a digital insurance card. These options include all necessary information without disclosing additional personal details.

What’s on the Declaration Page?

When you first purchase or renew your car insurance, your provider will send you a declaration page. While the format may vary between companies, they all contain the same essential information.

- Policy Number: This is the unique identifier for your insurance policy. You’ll need it whenever you file a claim or discuss your account.

- Policy Period: This shows the dates your coverage is active. Your policy will be effective from 12:01 a.m. on the start date to 12:01 a.m. on the expiration date.

- Named Insured: This is the primary policyholder. Any additional drivers in your household, like a spouse or teenage child, should also be listed here or in a separate “drivers” section.

- Vehicles: Every car covered by the policy will be listed, usually with its vehicle identification number (VIN), make, model, and year. It’s critical to check that this information is accurate for all your vehicles.

Coverages and Limits

This is the most important part of your declaration page, and the one that will matter most to your lender or lessor. In this section, you’ll see the specific types of coverage you have for each vehicle and the maximum amount your insurer will pay for a covered claim.

It might look something like this:

Insurance | Limits | Deductible |

Bodily Injury Liability | $20,000 each person / $40,000 each accident | N/A |

Personal Injury Protection | $8,000 each person | N/A |

Property Damage Liability | $100,000 each accident | N/A |

Collision | Actual Cash Value | $500 |

Comprehensive | Actual Cash Value | $500 |

Reading through this, you can confirm you have the coverage types you selected and see the limits for each. This is where you can assess if you have enough protection for your assets or if you’re just carrying your state’s minimum requirements.

You’ll notice for coverages like comprehensive and collision, you’ll see a deductible listed. A deductible is the amount of money you have to pay out of pocket on a claim before your insurance company starts to pay. For example, if you have a $500 collision deductible and get into an accident that causes $3,000 in damage, you would pay $500, and your insurer would cover the remaining $2,500.

Premiums and Discounts

This part of the page breaks down how much you’re paying for your policy. You’ll see the premium calculated for each vehicle and each type of coverage.

This section also lists all the discounts applied to your policy. It’s a good place to verify that you’re getting credit for things like being a good student, having multiple policies, or maintaining a safe driving record. If you think you qualify for a discount that isn’t listed, it’s worth looking into.

Why You Should Read Your Declaration Page

Whenever you get a new insurance policy, or even renew an existing one, it’s important to carefully review your declaration page for a few key reasons:

- To Verify Accuracy: Mistakes happen. You want to ensure your name, address, and vehicle information are all correct. An error, like an incorrect VIN, could cause major headaches if you need to file a claim.

- To Understand Your Coverage: Don’t wait until after an accident to find out you’re underinsured. The declaration page clearly states your coverage limits, allowing you to make an informed decision about whether your protection is adequate.

- To Confirm Your Discounts: Are you getting all the savings you deserve? The declaration page lets you see every discount being applied to your premium.

Your auto insurance declaration page is your best tool for understanding your coverage at a glance. By taking a few minutes to read it when it arrives, you can ensure your policy is accurate, your coverage is sufficient, and you’re getting the best value. Being an informed consumer is always the smartest way to manage your insurance costs.

Looking for new auto coverage? Check out our shopping tool to compare quotes and find the best deal.